Low cost deposits continue to report healthy growth

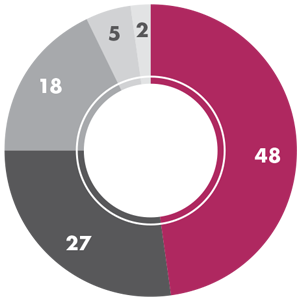

*Previous year figures have been adjusted to reflect the effect of sub-division of one equity share of the Bank having nominal value of H10 each into five equity shares of nominal value of `2 each.

Previous year figures have been re-grouped wherever necessary. All above figures are standalone.

5 year CAGR

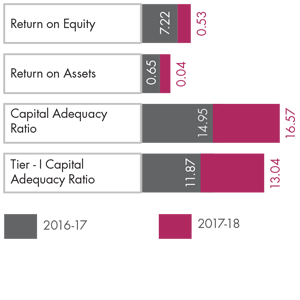

5 year CAGR  GROSS NPA

GROSS NPA